2. Health Insurance Marketplace (Covered California)

If you’re a California resident looking for health insurance, the Health Insurance Marketplace, also known as Covered California, is a great place to start. This state-based marketplace offers a variety of health insurance plans from different insurers, making it easier to find the right coverage for your needs and budget.

How Covered California Works

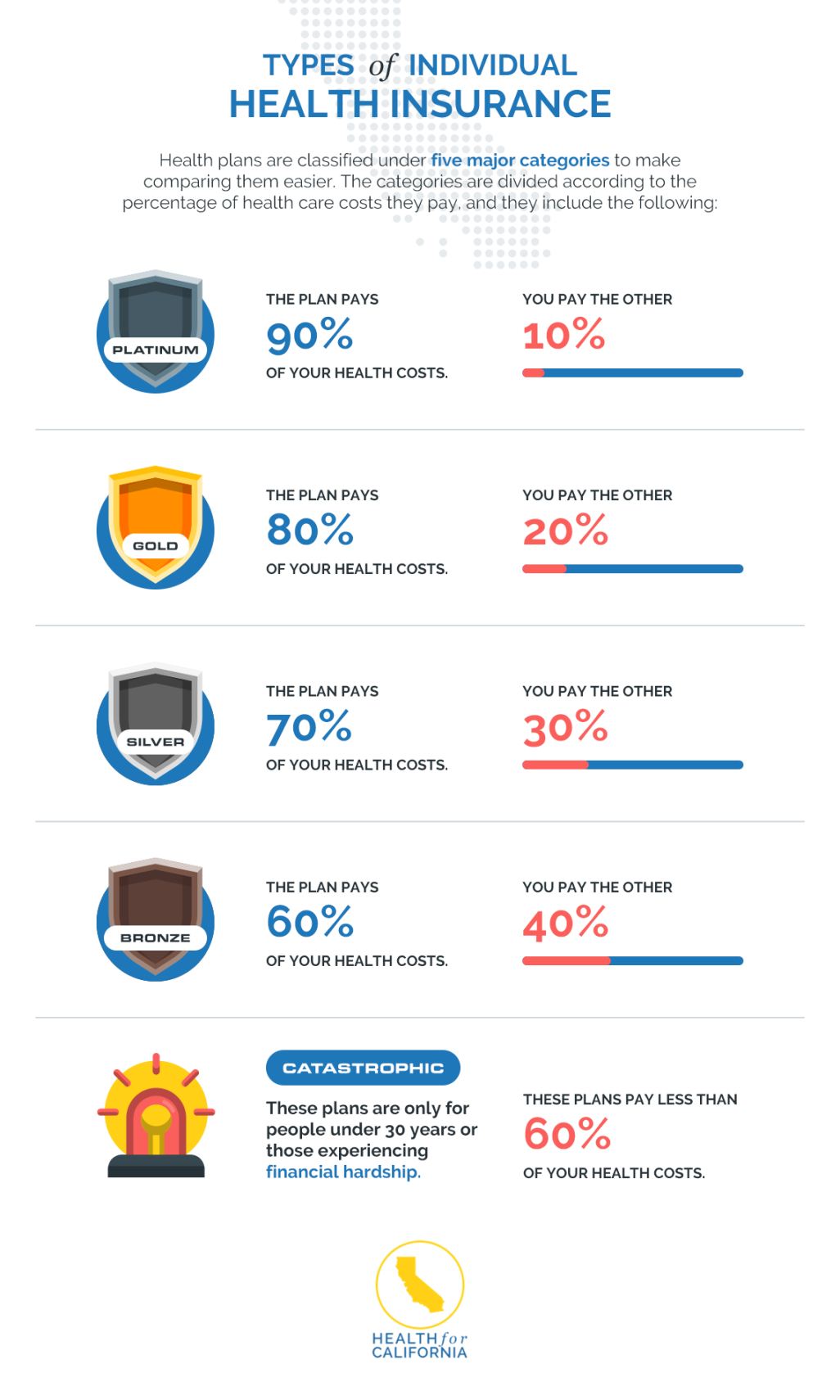

Covered California is a user-friendly online platform where you can browse through different health insurance plans, compare prices, and enroll in the one that best suits you. The marketplace offers a range of plan types, including:

Health Maintenance Organizations (HMOs): HMOs typically have a lower monthly premium and require you to choose a primary care physician (PCP). You’ll need a referral from your PCP to see specialists.

Finding the Right Plan

When choosing a health insurance plan on Covered California, consider the following factors:

Your budget: Determine how much you can afford to spend on monthly premiums and out-of-pocket costs.

Covered California offers a variety of tools to help you find the right plan, including:

A cost estimator: This tool allows you to estimate your monthly premium and out-of-pocket costs based on your income and health status.

Enrolling in a Plan

Open enrollment for Covered California typically takes place each year from November to January. However, you may be able to enroll outside of open enrollment if you qualify for a special enrollment period, such as losing your job or getting married.

To enroll in a health insurance plan on Covered California, you’ll need to provide some basic information about yourself and your family, such as your income, citizenship, and health status. Once you’ve selected a plan and completed the enrollment process, your coverage will typically start on the first day of the following month.

Additional Resources

If you have questions about Covered California or need help finding the right health insurance plan, you can visit the marketplace website or contact a certified insurance agent or broker.

Remember: Health insurance is an important investment in your health and financial well-being. By taking the time to understand your options and choose the right plan, you can ensure that you’re protected in case of unexpected medical expenses.

Udento Lifestyle & Health

Udento Lifestyle & Health