Health Savings Accounts (HSAs): a financial tool that’s gaining popularity due to its flexibility and tax advantages. If you’re looking for a way to save for future healthcare costs, an HSA could be the perfect solution for you.

What is an HSA?

An HSA is a tax-advantaged savings account that you can use to pay for qualified medical expenses. Unlike Flexible Spending Accounts (FSAs), which have a “use-it-or-lose-it” rule, HSAs allow you to carry over unused funds from year to year. This gives you more flexibility and control over your healthcare savings.

How does an HSA work?

To open an HSA, you must be enrolled in a high-deductible health insurance plan (HDHP). The minimum deductible for an HDHP varies depending on the year, but it’s generally higher than a traditional health insurance plan. Once you have an HDHP, you can open an HSA through a qualified HSA trustee.

Tax advantages of HSAs

One of the biggest benefits of HSAs is the tax advantages they offer. Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. Additionally, withdrawals from an HSA are tax-free when used to pay for qualified medical expenses. This includes costs for doctors’ visits, prescription drugs, hospital stays, and more.

Using your HSA wisely

While HSAs offer many benefits, it’s important to use them wisely. Here are some tips for getting the most out of your HSA:

Contribute regularly: The sooner you start contributing to your HSA, the more time your money has to grow.

HSA and retirement

In addition to paying for current medical expenses, HSAs can also be a valuable retirement planning tool. If you don’t need to use your HSA funds for current medical expenses, you can let them grow tax-free until retirement. At that point, you can withdraw the funds tax-free to pay for out-of-pocket medical expenses or for other purposes.

HSA vs. FSA

If you’re considering an HSA, it’s important to understand the differences between HSAs and FSAs. While both accounts offer tax advantages, HSAs have several key advantages:

Carryover: Unlike FSAs, HSAs allow you to carry over unused funds from year to year.

In conclusion

HSAs are a powerful financial tool that can help you save for future healthcare costs. By understanding how HSAs work and using them wisely, you can take advantage of the tax benefits they offer and secure your financial future.

Unlocking the Power of Your Health Savings Account

Have you ever wished there was a magical pocket that could help you pay for healthcare expenses? Well, good news! Your Health Savings Account (HSA) is that magical pocket, and logging in is your key to unlocking its potential.

What is an HSA?

An HSA is a tax-advantaged savings account that you can use to pay for qualified medical expenses. Think of it as your personal healthcare piggy bank. The best part? Contributions to your HSA are tax-deductible, and the money grows tax-free.

How Does HSA Login Work?

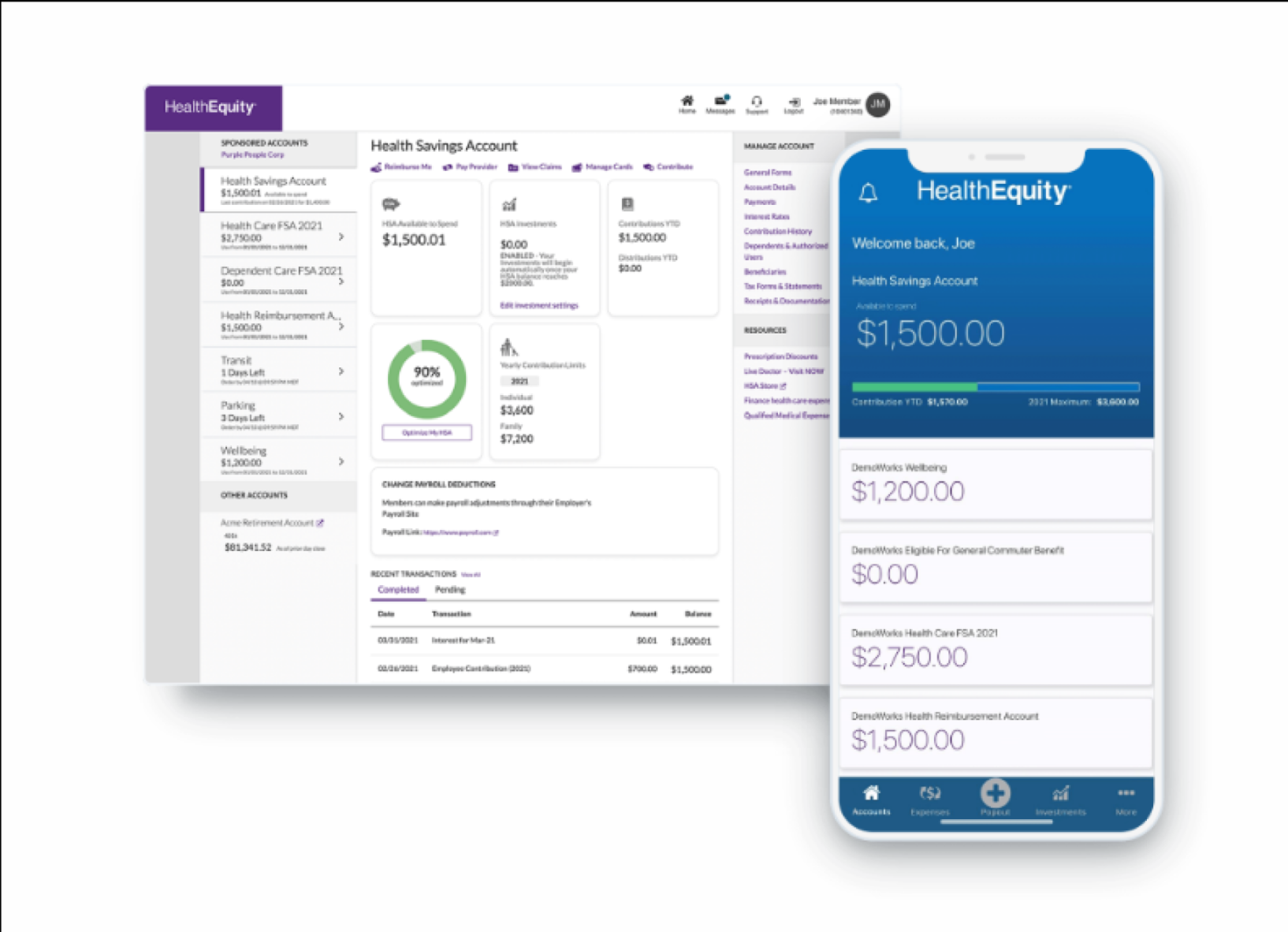

To access your HSA, you’ll need to log in to your online account. This usually involves entering your username and password. Once you’re logged in, you can:

Check your balance: See how much money you have saved for healthcare expenses.

The Benefits of HSA Login

Logging in to your HSA offers several advantages, including:

Convenience: Manage your healthcare finances from the comfort of your home.

Tips for Maximizing Your HSA

To get the most out of your HSA, consider these tips:

Contribute regularly: Make consistent contributions to your HSA throughout the year.

Real-Life Examples

Let’s see how HSA login can benefit people in different situations:

A young professional: John, a 25-year-old with a high-deductible health plan, uses his HSA to save for potential medical expenses. He contributes regularly to his account and enjoys the tax benefits.

HSA Login: A Pocket-Friendly Pathway to Healthcare

Logging in to your HSA is a simple yet powerful way to take control of your healthcare finances. By understanding the benefits and maximizing your HSA, you can enjoy peace of mind and affordability when it comes to your health.

Udento Lifestyle & Health

Udento Lifestyle & Health