Understanding the Zero Deductible

Have you ever heard someone mention a health insurance plan with a $0 deductible? If you’re not familiar with insurance terminology, this might sound like a magical concept. But what does it actually mean, and how can it benefit you? Let’s dive into the world of zero deductibles and explore why they’re becoming increasingly popular.

The Basics of Deductibles

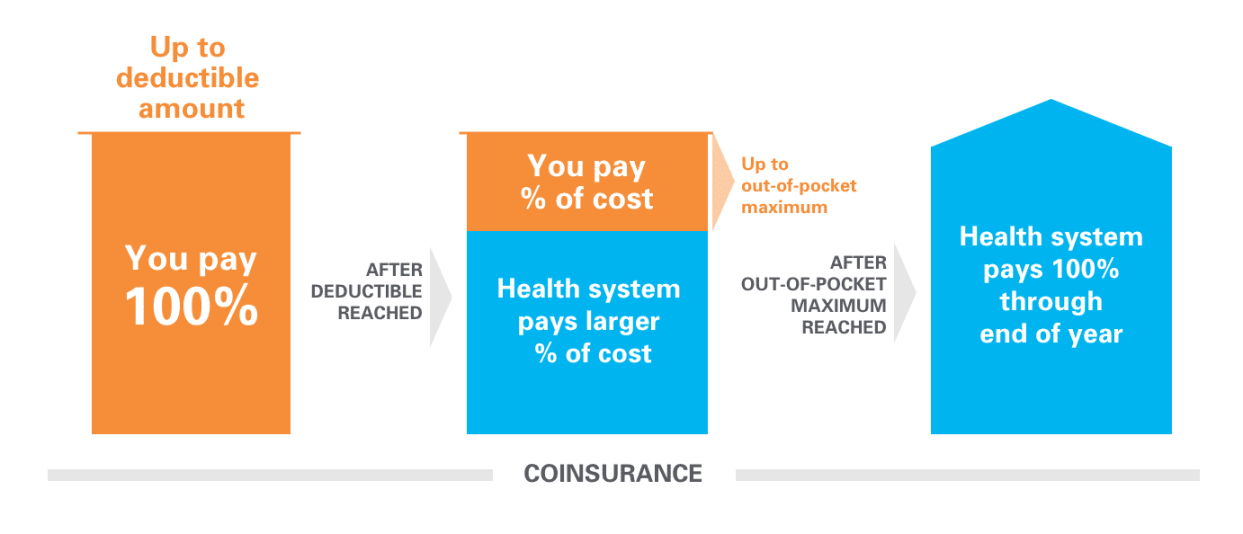

Before we delve into the specifics of a zero deductible, it’s important to understand what a deductible is in general. Think of a deductible as a “down payment” you make towards your healthcare costs. When you have a deductible, you’re responsible for paying that amount out of pocket before your insurance coverage kicks in. For instance, if you have a $1,000 deductible and a doctor’s visit costs $500, you’d pay the first $500 yourself. Only after you’ve met your deductible will your insurance start covering the remaining costs.

The Appeal of a Zero Deductible

So, why would someone choose a health insurance plan with a $0 deductible? The primary benefit is that you don’t have to pay anything upfront for your covered medical expenses. This can be a huge relief, especially if you’re facing unexpected healthcare costs or have a chronic condition that requires frequent medical attention.

Imagine having a sudden illness or accident. With a zero deductible, you can seek treatment without worrying about the financial burden. This can help you get the care you need promptly, potentially leading to better health outcomes. Additionally, a zero deductible can provide peace of mind, knowing that you won’t be hit with unexpected medical bills.

Factors to Consider

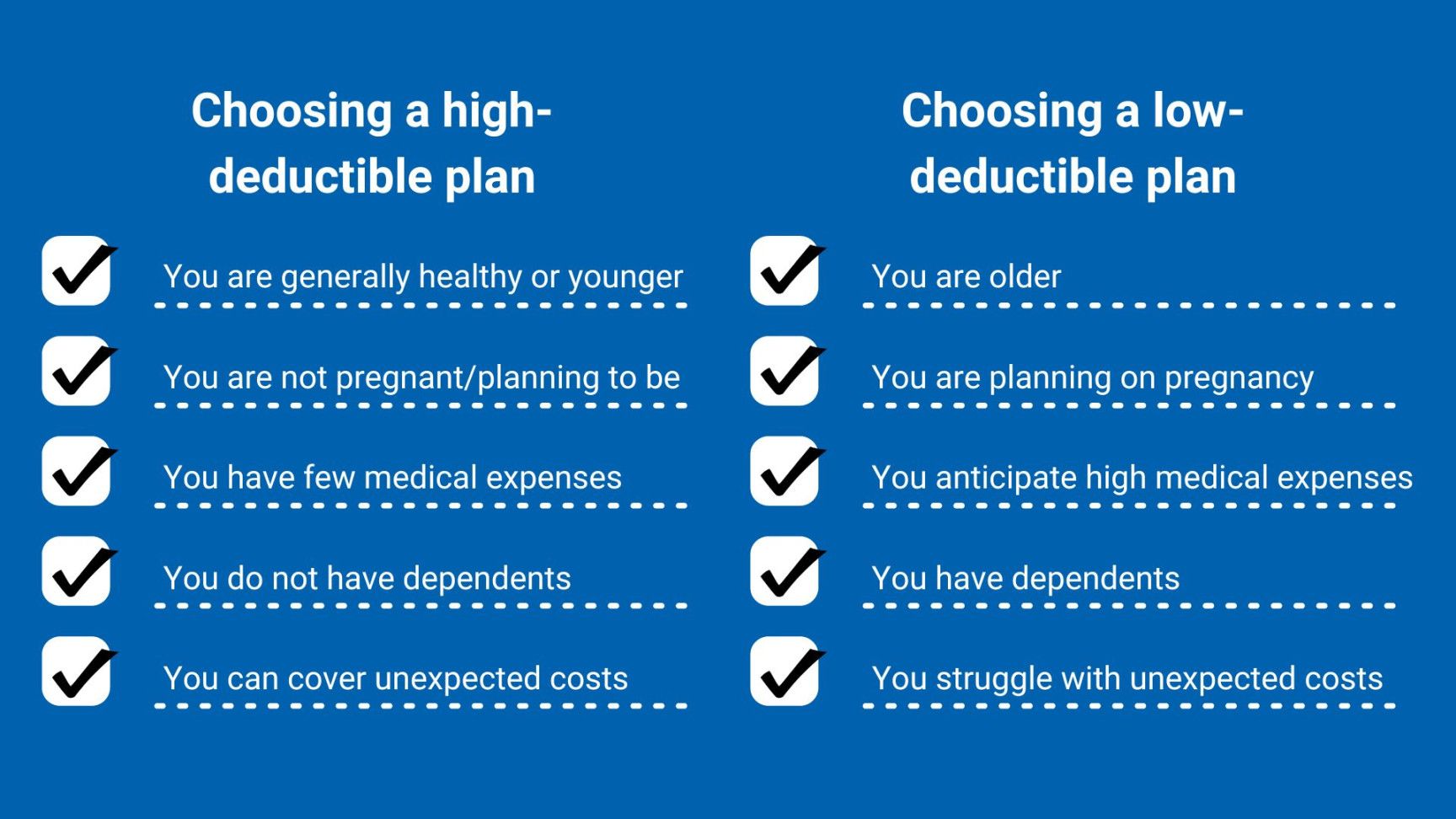

While a zero deductible offers many advantages, it’s important to consider the potential drawbacks. Typically, health insurance plans with lower deductibles come with higher monthly premiums. This means you’ll pay more each month for your coverage. Therefore, it’s essential to weigh the pros and cons and determine if the higher premiums are worth the peace of mind of a zero deductible.

Another factor to consider is your overall health and lifestyle. If you’re generally healthy and rarely visit the doctor, a higher deductible plan might be more cost-effective. However, if you have pre-existing conditions or anticipate needing frequent medical care, a zero deductible plan could be a better investment.

A Personal Perspective

To illustrate the benefits of a zero deductible, let’s consider a hypothetical scenario. Imagine you’re a young professional with a stable job. You’re generally healthy, but you’re concerned about unexpected medical expenses. You decide to opt for a health insurance plan with a zero deductible.

One day, you accidentally sprain your ankle while playing sports. You visit the emergency room for treatment. Without a deductible, you’re able to receive immediate care without worrying about the cost. The insurance covers the entire bill, relieving you of financial stress during a time when you need to focus on your recovery.

Conclusion

A zero deductible can be a valuable feature in a health insurance plan, offering peace of mind and financial protection. However, it’s important to carefully evaluate your individual needs and budget to determine if it’s the right choice for you. By understanding the benefits and drawbacks of zero deductibles, you can make an informed decision that best suits your healthcare needs.

Udento Lifestyle & Health

Udento Lifestyle & Health