Understanding the Basics: What is Health Insurance?

Imagine health insurance as a safety net, a protective blanket that shields you from unexpected medical expenses. It’s like a financial first-aid kit, always ready to help when you need it most. In Texas, where the sun shines bright and the healthcare landscape is vast, understanding health insurance is crucial.

So, what exactly is health insurance?

At its core, health insurance is a contract between you and an insurance company. You pay a regular fee, called a premium, and in return, the insurance company agrees to cover a portion of your medical expenses. This coverage can include doctor’s visits, hospital stays, prescription drugs, and more.

Types of Health Insurance in Texas

Texas offers a variety of health insurance plans, each with its own unique features and benefits. Here’s a brief overview of the most common types:

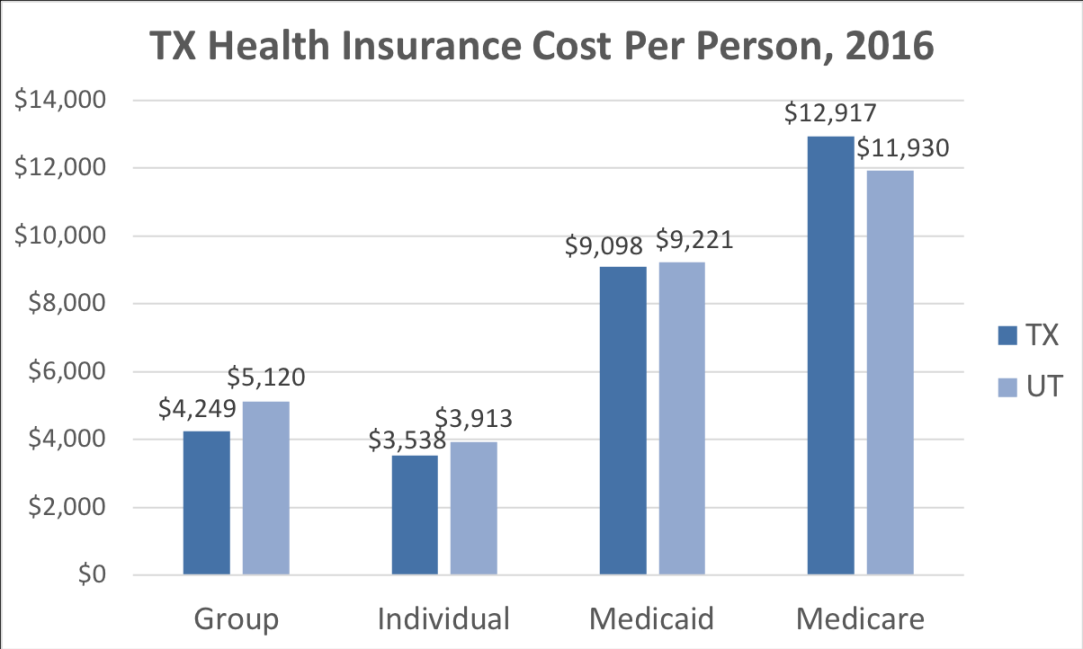

Individual Health Insurance: This type of plan is designed for individuals and families who aren’t covered by an employer’s health insurance plan. It offers flexibility but can be more expensive than employer-sponsored plans.

Key Terms to Know

Premium: The regular fee you pay to maintain your health insurance coverage.

Finding the Right Plan for You

Choosing the right health insurance plan can be overwhelming, but with a little research and planning, you can find a plan that fits your needs and budget. Consider the following factors when making your decision:

Your health needs: Do you have any pre-existing conditions? How often do you need medical care?

Open Enrollment and Special Enrollment Periods

Health insurance coverage typically runs on an annual cycle. There are specific times of the year, known as open enrollment periods, when you can enroll in or change your health insurance plan. If you miss the open enrollment period, you may be able to enroll in a plan during a special enrollment period, such as when you lose your job or have a baby.

Health Insurance Exchanges

In Texas, you can find and purchase health insurance plans through the state’s health insurance exchange, Healthcare.gov. The exchange provides a platform for comparing plans, estimating costs, and enrolling in coverage.

Texas-Specific Considerations

Texas has a diverse healthcare landscape, with both urban and rural areas. Factors like your location, income, and health status can influence your health insurance options. It’s important to research the specific providers and facilities available in your area to ensure you have access to the care you need.

Remember, health insurance is an investment in your well-being. By understanding the basics and carefully considering your options, you can find a plan that provides the coverage you need at a price you can afford.

2. Healthcare Exchanges

Healthcare exchanges, also known as health insurance marketplaces, are online platforms where individuals and small businesses can shop for and compare health insurance plans. These platforms are designed to make the process of finding affordable coverage easier and more accessible.

How do healthcare exchanges work?

When you visit a healthcare exchange, you’ll be asked to provide some basic information about yourself, such as your income, age, and family status. This information will be used to determine your eligibility for subsidies or tax credits that can help lower your premium costs.

Once you’ve provided your information, you’ll be able to browse through a variety of health insurance plans offered by different insurers. You can compare plans based on factors such as:

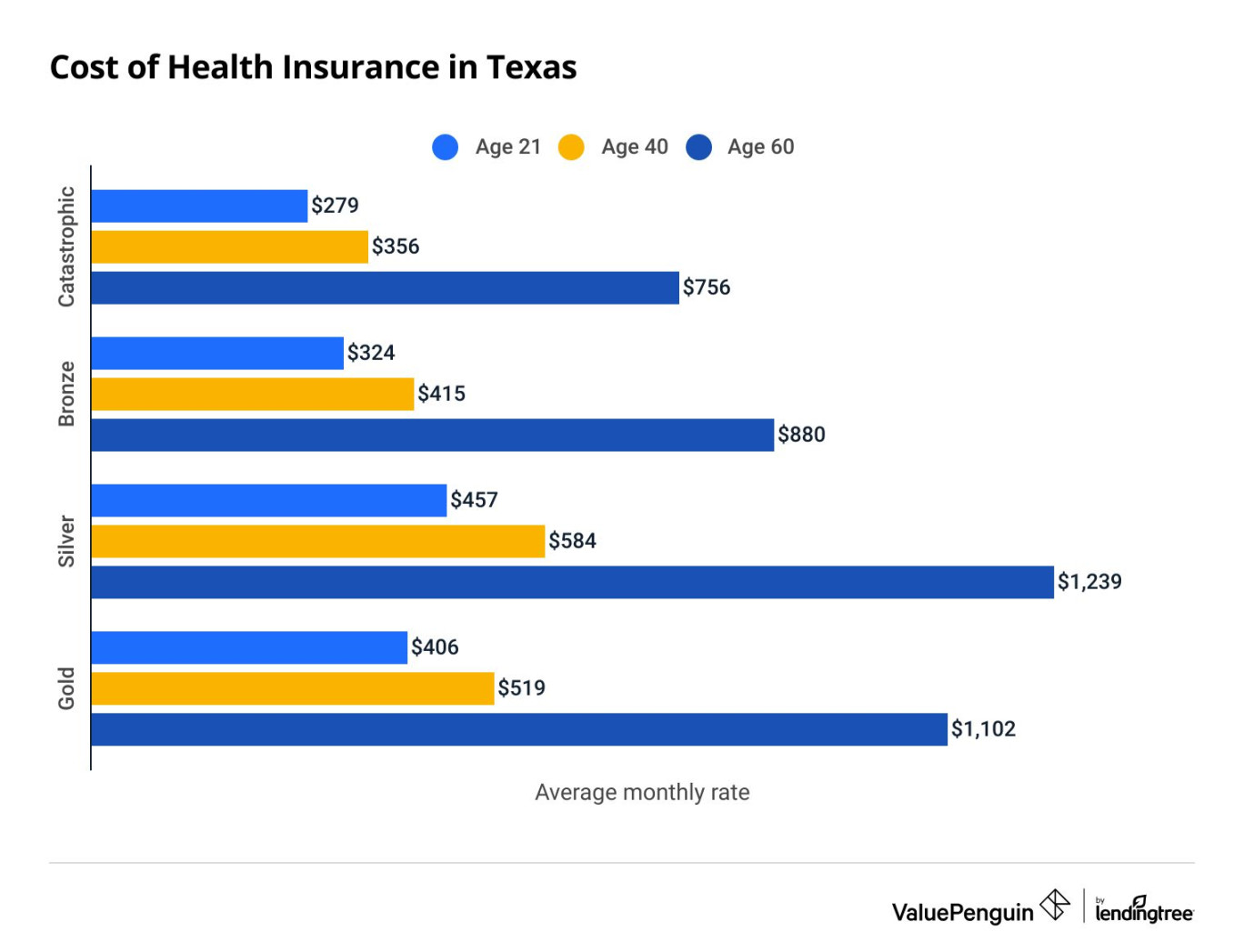

Premium costs: This is the monthly amount you’ll pay for your insurance.

Who is eligible for healthcare exchanges?

Most people who are U.S. citizens or legal residents are eligible to use healthcare exchanges. However, there are some exceptions. For example, people who are already enrolled in Medicare or Medicaid are not eligible to use exchanges.

What are the benefits of using healthcare exchanges?

There are several benefits to using healthcare exchanges, including:

Affordability: Many people are eligible for subsidies or tax credits that can help lower their premium costs.

How do I find a healthcare exchange?

You can find your state’s healthcare exchange by visiting the official website of the Health Insurance Marketplace. You can also find information about healthcare exchanges by contacting your state’s insurance department.

Texas-Specific Information

Texas operates its own healthcare exchange, called the Texas Health Insurance Marketplace. The marketplace offers a variety of health insurance plans from different insurers, including both private and public options.

If you live in Texas, you can visit the Texas Health Insurance Marketplace website to learn more about your options and to enroll in coverage. You can also find information about healthcare exchanges in Texas by contacting the Texas Department of Insurance.

Additional Tips

Here are a few additional tips for using healthcare exchanges:

Start early: The open enrollment period for healthcare exchanges typically runs from November to December each year. It’s important to start shopping for coverage early to ensure that you have time to compare plans and enroll in the one that’s right for you.

Udento Lifestyle & Health

Udento Lifestyle & Health