Imagine a world where health care isn’t a financial burden. A world where you can visit the doctor, undergo necessary treatments, and receive medications without worrying about out-of-pocket costs. This isn’t a pipe dream; it’s a reality made possible by zero-deductible health plans.

What is a Zero-Deductible Health Plan?

A zero-deductible health plan is a type of health insurance that eliminates the upfront cost known as a deductible. This means that you don’t have to pay a specific amount out of pocket before your insurance coverage kicks in. It’s like having a safety net that catches you before you even fall.

Why Choose a Zero-Deductible Plan?

There are several compelling reasons to consider a zero-deductible health plan:

1. Peace of Mind: Knowing that you won’t face unexpected medical bills can significantly reduce stress and provide peace of mind.

2. Proactive Healthcare: Without the financial barrier of a deductible, you’re more likely to seek preventive care and address health concerns promptly, potentially preventing more serious issues down the line.

3. Unexpected Emergencies: Life can be unpredictable, and medical emergencies can arise at any time. A zero-deductible plan ensures that you’re covered for unexpected costs, preventing financial strain during a difficult time.

4. Long-Term Savings: While zero-deductible plans often come with higher monthly premiums, the potential savings on out-of-pocket costs can outweigh the additional expense, especially if you have frequent medical needs.

5. Simplified Billing: With no deductible, your insurance claims are processed more straightforwardly, reducing the administrative burden and making it easier to understand your healthcare costs.

How Does a Zero-Deductible Plan Work?

While the concept is simple, the specifics of zero-deductible plans can vary depending on your insurance provider. Generally, these plans have higher monthly premiums compared to plans with deductibles. However, the savings on out-of-pocket costs can make them a worthwhile investment for many people.

Tips for Choosing a Zero-Deductible Plan

When selecting a zero-deductible health plan, consider the following factors:

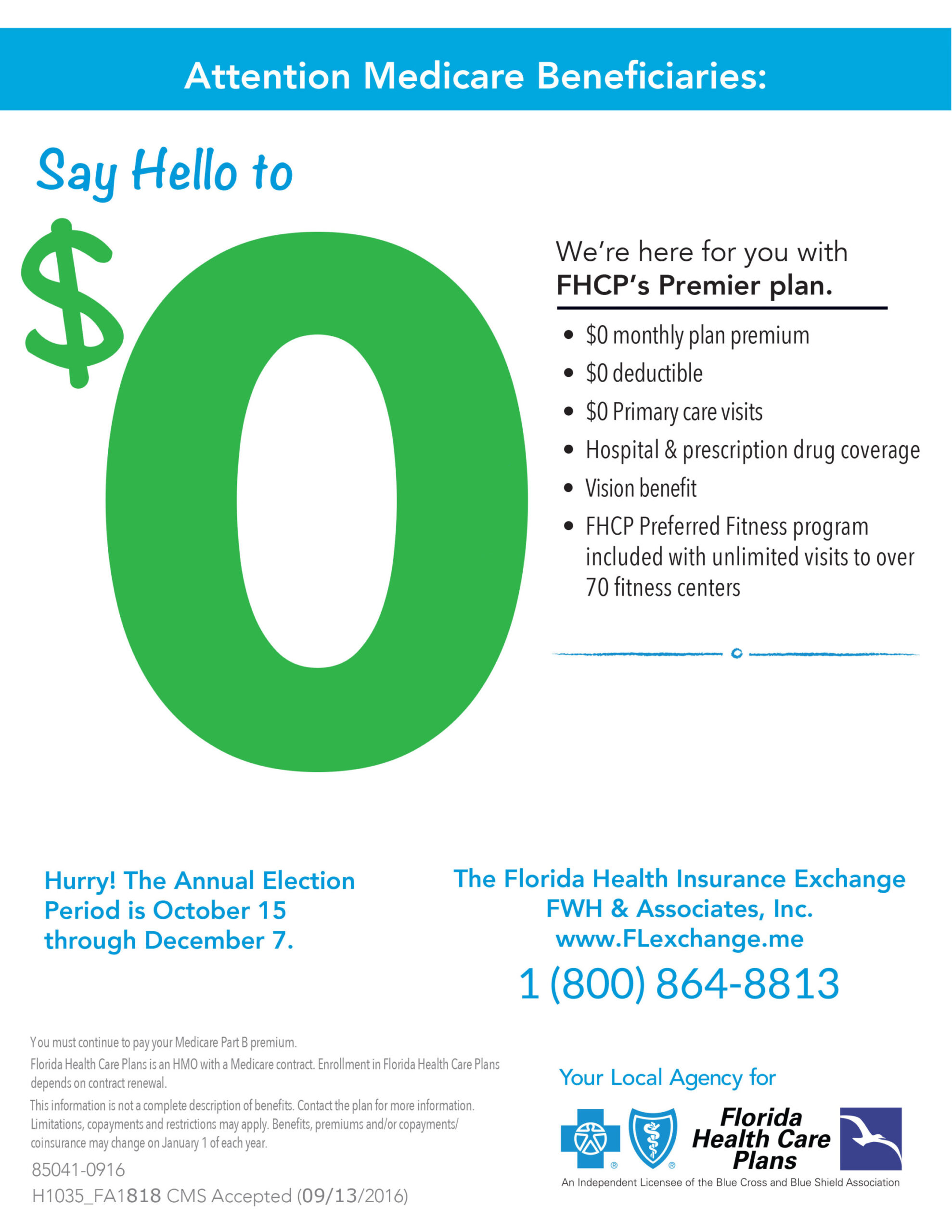

Network: Ensure that the plan’s network includes doctors, hospitals, and pharmacies that you frequently use.

A Healthier Future

A zero-deductible health plan can be a game-changer for individuals and families seeking peace of mind and access to quality healthcare. By eliminating the financial burden of a deductible, these plans empower you to prioritize your health and make proactive decisions about your well-being.

Imagine a world where healthcare is as worry-free as a day at the beach. No more fretting over unexpected medical bills or second-guessing necessary treatments. This utopian vision is becoming a reality with the rise of zero-deductible health plans.

What is a zero-deductible health plan?

In essence, a zero-deductible health plan is a type of insurance coverage that eliminates the upfront cost known as a deductible. This means that you don’t have to pay a certain amount out-of-pocket before your insurance kicks in. It’s like having a safety net that catches you before you even fall.

Why choose a zero-deductible health plan?

1. Peace of Mind: Knowing that you won’t be burdened with unexpected medical expenses can significantly reduce stress. It’s like having a financial cushion that protects you and your loved ones.

2. Financial Freedom: Without a deductible, you’re more likely to seek out preventive care and necessary treatments without worrying about the cost. This can lead to better overall health and potentially save you money in the long run.

3. Enhanced Access to Care: When you have a zero-deductible plan, you’re more likely to see a doctor or specialist when you need to, rather than delaying care due to financial concerns. This can improve your health outcomes and prevent more serious conditions from developing.

4. Potential Savings: While zero-deductible plans often have higher monthly premiums, they can be cost-effective in the long run, especially if you have frequent medical needs. By avoiding out-of-pocket expenses, you can potentially save money overall.

Tips for Choosing a Zero-Deductible Health Plan:

1. Consider Your Needs: Evaluate your health history and anticipated medical needs to determine if a zero-deductible plan is the right choice for you.

2. Compare Costs: While zero-deductible plans may have higher premiums, it’s important to compare the total cost of coverage over time, including potential out-of-pocket expenses.

3. Check for Co-pays and Co-insurance: Be aware of any co-pays or co-insurance requirements, as these can still impact your out-of-pocket costs.

4. Understand the Network: Ensure that your preferred doctors and hospitals are in-network with your chosen plan.

Real-Life Stories of Zero-Deductible Bliss:

Sarah’s Story: Sarah, a young mother of two, recently switched to a zero-deductible health plan. When her son developed a mysterious illness, she didn’t hesitate to seek medical attention without worrying about the cost. Thanks to her coverage, she was able to get her son the care he needed quickly and efficiently.

In conclusion, a zero-deductible health plan can provide peace of mind, financial freedom, and enhanced access to care. By understanding your options and making an informed decision, you can enjoy the benefits of this innovative coverage and take control of your healthcare journey.

Udento Lifestyle & Health

Udento Lifestyle & Health